Many ask if they can still get a VA Loan after filing for a Chapter 7 Bankruptcy? Like others, you may have been drowning in debt, desperately seeking a fresh start. Bankruptcy might be the lifeline you need. Chapter 7 bankruptcy offers individuals overwhelmed by financial burdens an opportunity to wipe the slate clean and regain control of their lives. It is a bankruptcy that allows for the discharge of certain debts, providing much-needed relief from creditor harassment and collection actions.

But what exactly does filing for bankruptcy entail? How does it affect your financial history and future prospects? These are important questions that many face when considering this path. Understanding the different chapters of bankruptcy, such as Chapter 7, is crucial to making informed decisions about your financial situation. This article is intended to refresh your memory on qualifications for filing for Chapter 7 and provide details on getting a VA Loan after bankruptcy.

So if you’re curious about whether Chapter 7 bankruptcy could offer you a fresh start or have specific questions about your own circumstances, keep reading to gain valuable insights.

Qualifications for Chapter 7 Bankruptcy

To be eligible for Chapter 7 bankruptcy, there are certain requirements that individuals need to meet. Here’s a breakdown of the qualifications:

- Means Test: One must pass the means test, which evaluates income and expenses to determine if an individual qualifies for Chapter 7 bankruptcy.

- Primarily Consumer Debts: Individuals with primarily consumer debts are eligible for Chapter 7 bankruptcy. This includes debts incurred for personal or household purposes.

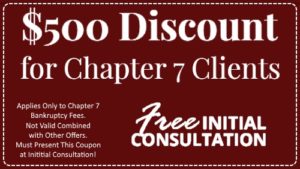

- No Minimum Debt Requirement: Unlike other forms of bankruptcy, there is no minimum amount of debt required to file for Chapter 7. The Law Offices of Daniel J. Guenther can help you calculate that.

Veterans may face additional considerations. While good credit is generally preferred by mortgage lenders, those with low credit scores can still qualify for a VA loan under certain circumstances.

Here are some key points regarding VA loans after Chapter 7 bankruptcy:

- Waiting Period: There is typically a waiting period before veterans can apply for a VA loan after filing for Chapter 7 bankruptcy. The length of this waiting period varies depending on the specific circumstances and requirements set by different VA lenders.

- Credit Score Requirements: While there isn’t an exact credit score requirement, having a higher credit score can improve the chances of approval, speed up approval, or potentially lead to more favorable terms.

- Eligibility Criteria: Veterans who have successfully completed their waiting period and meet all other eligibility criteria set by VA lenders can apply for a VA loan after Chapter 7.

Understanding the Process of Chapter 7 Bankruptcy

Filing for Chapter 7 bankruptcy involves a specific process that individuals must follow. Here’s a brief overview of the steps involved:

- Filing a Petition and Necessary Documents: The first step in the process is to file a petition with the court. This includes providing all the necessary documents, such as financial statements, tax returns, and a list of creditors.

- Automatic Stay Halts Collection Efforts: Once the petition is filed, an automatic stay goes into effect. This means that creditors are prohibited from taking any collection actions against you while the bankruptcy process is underway.

- Trustee Appointed to Review Assets: A trustee is appointed by the court to oversee your case. They will review your assets to determine if there are any non-exempt properties that can be liquidated to repay your creditors.

- Paricipate in a meeting of creditors hearing.

- Obtain a Final Discharge: This results in closure of case; often approximately three months after filing.

Understanding this process is crucial when considering financing options after Chapter 7 bankruptcy. By being aware of what happens during this legal procedure, individuals can navigate their financial situation more effectively and make informed decisions moving forward.

Dischargeable and Non-Dischargeable Debts

Understanding which debts can be discharged and which cannot is crucial for borrowers seeking a fresh financial start. Here’s a breakdown of dischargeable and non-dischargeable debts after filing for Chapter 7 bankruptcy.

Dischargeable Debts

- Credit card bills: Unsecured credit card debt can typically be discharged through bankruptcy.

- Medical bills: Debts incurred from medical expenses are generally dischargeable in bankruptcy.

- Personal loans: Unsecured personal loans, such as those obtained from friends or family members, may be discharged.

- Auto Loans: If you want to surrender the vehicle.

Non-Dischargeable Debts

- Student loans: In most cases, student loans cannot be discharged unless the borrower can prove undue hardship.

- Child support: Debts related to child support obligations are not dischargeable in bankruptcy.

- Certain tax obligations: While some tax debts may be dischargeable, others, such as recent income tax liabilities, are typically non-dischargeable.

- Debts incurred through fraud or illegal activities: Any debts resulting from fraudulent or illegal actions may not be eligible for discharge.

It’s important for individuals considering bankruptcy to consult with an attorney to determine the specific implications for their situation. Bankruptcy laws vary by jurisdiction and individual circumstances.

Property Exemptions and Asset Protection

- Homestead exemption safeguards the equity in your primary residence, ensuring protection up to a specific limit.

- Personal property exemptions cover essential items such as clothing, furniture, bank accounts and vehicles within specified limits.

- Consulting with an attorney allows you to maximize asset protection utilizing state-specific exemptions.

When filing for Chapter 7 bankruptcy, understanding property exemptions and asset protection is crucial. By taking advantage of these exemptions, you can safeguard your assets while benefiting from a VA loan after Chapter 7. Here’s what you need to know:

Homestead Exemption

One of the key benefits is the homestead exemption, which protects the equity in your primary residence. This means that a portion of your home’s value can be shielded from creditors during bankruptcy proceedings. However, it’s important to note that there are limits on how much equity can be protected under this exemption.

Personal Property Exemptions

In addition to protecting your home, personal property exemptions safeguard other essential items you own. These may include clothing, furniture, vehicles, and more. Each state has its own limits on the value of personal property that can be exempted. It’s advisable to consult with an attorney who specializes in bankruptcy law to understand the specific exemptions applicable in your state.

Maximizing Asset Protection To ensure you maximize asset protection under state-specific exemptions, seeking guidance from an experienced attorney is highly recommended. They will help evaluate your financial situation and provide advice tailored to your needs. By leveraging their expertise, you can make informed decisions regarding asset protection while pursuing a VA loan after Chapter 7 bankruptcy.

Remember that each case is unique; therefore, consulting with a professional will provide personalized insights into how best to protect your assets during bankruptcy proceedings.

Trustee Appointment and Meeting of Creditors

In a Chapter 7 bankruptcy, the court appoints a trustee to oversee the entire process impartially. The trustee plays a crucial role in ensuring that all parties involved follow the necessary legal procedures. One significant event during this process is the Meeting of Creditors, which provides an opportunity for creditors to inquire about the debtor’s financial situation under oath.

During the Meeting of Creditors, creditors have the chance to ask questions directly to the debtor. However, it is important to note that creditors rarely attend these meetings. This meeting serves as a platform for creditors to gain insights into the debtor’s financial affairs and assess their ability to repay outstanding debts.

The trustee ensures that this meeting proceeds smoothly and fairly. They review documents submitted by the debtor, verify information provided, and ensure compliance with bankruptcy laws. If any fraudulent activities or discrepancies are discovered, it becomes their responsibility to address them appropriately.

Understanding this process is crucial for individuals seeking VA loan approval after Chapter 7 bankruptcy. The trustee’s involvement helps maintain transparency and fairness throughout the proceedings. It also ensures that all parties involved have an opportunity to present their case and resolve any outstanding issues.

Ultimately, once the bankruptcy process concludes successfully under the supervision of a court-appointed trustee, individuals can work towards rebuilding their financial lives. With careful planning, veterans can take advantage of VA loan benefits offered by Veterans Affairs (VA). These loans provide opportunities for eligible veterans and service members to obtain financing for homeownership while recovering from past financial challenges.

By navigating through bankruptcy proceedings with guidance from trustees appointed by courts, individuals can create a feasible plan for moving forward financially while still being able to pursue their dreams of homeownership through VA loans.

Life After Chapter 7 Bankruptcy

Congratulations on completing the sections about Chapter 7 bankruptcy! You now have a better understanding of the qualifications, process, debts, exemptions, and trustee appointment involved. But what happens next? Life after Chapter 7 bankruptcy can be a fresh start for you. It’s time to rebuild your credit and work towards financial stability. Remember, it won’t happen overnight, but with patience and discipline, you can bounce back stronger than ever.

To begin your journey towards recovery, start by creating a budget and sticking to it. Focus on paying your bills on time and keeping your credit utilization low. Consider applying for a secured credit card or getting a card in your name to rebuild your credit history. And don’t forget to regularly check your credit reports for any errors or discrepancies that may impact your score.

FAQs:

Can I qualify for a VA loan after filing for Chapter 7 bankruptcy?

Yes, it is possible to qualify for a VA loan after filing for Chapter 7 bankruptcy. However, there are certain waiting periods you must adhere to before being eligible. Typically, you will need to wait two years from the discharge date of your bankruptcy before applying for a VA loan.

Will my previous Chapter 7 bankruptcy affect my ability to get approved for a VA loan?

While having filed for Chapter 7 bankruptcy in the past may impact your creditworthiness initially, it does not automatically disqualify you from getting approved for a VA loan. Lenders will consider various factors such as your current financial situation and post bankruptcy credit history when evaluating your application.

Can I apply for a VA loan during an open Chapter 7 bankruptcy case?

No, you cannot apply for a VA loan while still in an open Chapter 7 bankruptcy case. The waiting period mentioned earlier begins once the court has closed or dismissed your bankruptcy case.

How long does a Chapter 7 bankruptcy stay on my credit report?

A Chapter 7 bankruptcy can stay on your credit report for up to ten years from the date of filing. However, its impact on your credit score lessens over time as you demonstrate responsible financial behavior. In fact, your credit score could go up after a Chapter 7 Bankruptcy.

Are there any alternatives to a VA loan if I have filed for Chapter 7 bankruptcy?

Yes, there are alternative loan options available if you have filed for Chapter 7 bankruptcy. You may explore FHA loans or conventional loans offered by different lenders. It’s essential to shop around and compare rates and terms to find the best option that suits your needs.

Remember, it’s crucial to consult with an attorney or qualified mortgage professional who can guide you through the process and provide personalized advice based on your unique situation.

The foregoing is not intended to be legal advice. These are all very complicated issues and a primary reason why you should seek the advice of a competent bankruptcy attorney. The Law Offices of Daniel J. Guenther are here to help you. Give us a call at (301) 475-3106. We are prepared to meet with you at our offices, remotely, and by phone. We are proudly designated by Congress as a Debt Relief Agency helping people get out of debt through Bankruptcy.