The rising credit card interest rates can lead to bankruptcy for many families in Southern Maryland. This is unfortunate but an everyday reality these days. This article will address the reasons behind rising credit card interest rates and recommend potential solutions.

Rising Credit Card Interest Rates: Why?

Credit card interest rates have risen to record highs, some topping 30% APR.

According to Bankrate’s annual retail cards survey, the annual percentage rate (APR) on retail credit cards this year has hit a record high of 28.93% on average, up from 26.72% in 2022. The survey shows that that’s well above the average APR of 21.19% for all credit cards.

The rising APRs come as the Federal Reserve hiked interest rates, indirectly increasing the cost of borrowing for consumers and emboldening credit card companies to raise their cards’ interest rates as well, Ted Rossman, Senior Industry Analyst at Bankrate.com.

Most Americans are already in debt as they take out more credit card debt as they struggle with rising inflation, according to data from the Federal Reserve Bank of New York. The same data shows that Americans are buried in nearly a trillion dollars in credit card debt and now owe almost a record combined $986 billion on their credit cards, or 17% more than what they owed last year.

Rising Credit Card Interest Rates: Why Did the Interest Rate Rise on Your Cards?

As a credit card holder, you likely depend on your card’s terms to stay the same. However, there are sometimes when this doesn’t happen. For many reasons, your credit card issuer may increase your annual percentage rate, or APR. This is one of the terms most likely to change for your credit card — and it can affect your account when it does.

Your APR determines how much you shell out for monthly payments and how quickly you can pay down your credit card debt. If your credit card APR has increased, you may need clarification on your options. Here’s what you can do if your issuer has increased your credit card APR.

Some reasons why credit card APR increases?

1. The prime rate changed.

Most credit card APRs are tied to the prime rate, which many lenders use for financial products like credit cards, mortgages, and auto loans. When the Federal Reserve adjusts the federal funds rate (or the interest rate banks charge each other for overnight lending), it can also affect variable-rate credit products. In this case, your credit card APR will be involved.

When the federal funds rate increases, it’s a rate hike. And in the spring of 2022, the Fed announced its plan to enact several rate hikes over the year and beyond. So far, there have been 11 rate hikes since March 2022 — most recently by a quarter of a percentage point on July 26, 2023. On Nov. 1, 2023, the Fed decided to maintain its target range at 5.25 to 5.50 percent for a second consecutive time.

Carrying a balance can get very expensive in the days of rising interest rates. However, with some planning and diligence, you can get ahead of APR increases, which we’ll discuss below.

2. You paid your credit card bill late.

If you don’t pay your credit card bill on time, your card issuer may charge a penalty APR, which could be upward of 29.99 percent. If your issuer gave you a regular APR, or you have a 0 percent introductory APR offer via your card, this penalty APR will replace your previous rate.

If this happens to you, the penalty APR may not be permanent. If you resume making payments on time, your card issuer should review your account and reinstate your regular APR.

3. Your introductory APR offer is over.

The offer may have expired if you received an introductory APR offer as a new cardholder. This promotional offer gives cardholders a lower interest rate for a predetermined period. When this promotional rate ends, your regular APR is applied to any balance you may carry on the card.

4. Your credit score dropped.

When your credit score decreases, it could cause your lender to perceive you as more of a credit risk, which is why it will charge a higher APR for the money you are borrowing. Once your card issuer notices a drop in your score, it can set a new, higher APR. You can opt out of the higher rate once notified of the upcoming change.

It’s never fun to see the terms of your credit cards change, especially if the changes are not in your favor. Even a minor adjustment in your card’s APR could mean taking more hard-earned money out of your wallet.

Generally, the best practice is to avoid carrying a balance on your credit card. But if you have one when your APR increases, you still have to deal with it. The good news is that you still have options to come out ahead in this situation.

Rising Credit Card Interest Rates: Struggling to Keep Up

“Typically, credit card companies take the Fed’s rate and then add an additional interest amount,” says Bill Hardekopf, senior industry analyst at Money Crashers. “It might be that the Federal Reserve rate is the foundation, and then they might take it up, say, 6.99% to 12.99%. That extra 6.99% is if you have excellent credit, and the 12.99% might be if you have good or fair credit.”

When the Fed raises interest rates, credit card issuers typically pass along the higher interest rates to cardholders within one or two statement cycles.

If the Federal Reserve raises its rate by half a percentage point, for instance, it will likely result in a half percentage point, or 0.50%, bump in your credit card interest rate. So, if your APR is currently 16%, your rate may jump to 16.50%. When the Fed raises interest rates, credit card issuers typically pass along the higher interest rates to cardholders within one or two statement cycles.

Rising Credit Card Interest Rates: You Are Not Alone

The Household Credit Card Debt Study by NerdWallet found that, in total, Americans are carrying $905 billion in credit card debt, which is a significant eight percent increase from one year ago. On average, American households are carrying $15,654 in credit card debt. Combined with the $8.74 trillion Americans owe on their mortgages, the $1.21 trillion in car loans they have, and the $1.36 trillion they are carrying in student loans, the overall debt load is becoming overwhelming.

The reason that credit card debt is up is precisely because other debts and expenses are also up. Medical debt is the main driver behind the increasing credit card debt. The study found that 17 percent of Americans are in debt due to medical expenses, and 27 million adults have charged medical expenses to their credit cards. Spending on food and housing is also up 22 and 20 percent, respectively, and healthcare costs have risen by 34 percent in the last ten years. In comparison, incomes have failed to keep up, growing by just 20 percent and forcing more people to put basic expenses on their credit cards.

Rising Credit Card Interest Rates: Good News May be Coming

The Federal Reserve first meeting this year amid widespread speculation about when it will begin cutting its benchmark interest rate, which is currently at a 22-year high. The central bank has already forecasted it will reduce rates by three-quarters of a point this year, but officials have said little about the timing. Over time, a lower rate should reduce the cost of mortgages, auto loans, and other consumer and business borrowing. Most economists expect the first cut to occur in May or June, though March is not completely off the table.

In conclusion, when interest rates rise, the cost of borrowing increases, making it more expensive for families to borrow money. This can strain cash flow, making it difficult to pay their bills and ultimately leading to bankruptcy. Between the current inflationary pressures on consumer prices and the rising interest rates on credit card debt, many people struggle to repay debt and keep up with living expenses.

For those struggling to keep up, any impending rise in interest rates could be more than they can handle. Instead of getting into an endless cycle of simply trying to make minimum payments, those drowning in debt should talk to a bankruptcy attorney. While bankruptcy can sound frightening, in many cases, it could be the best way to discharge most debts and help individuals get the breathing room they need to rebuild their finances on more solid ground.

Filing bankruptcy can relieve the pressure of high debt and give you a fresh start. It won’t increase income, but it will allow you to devote your income to the critical living expenses in the current economy.

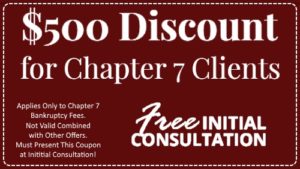

The preceding is not intended to be legal advice. These are all very complicated issues and a primary reason why you should seek the advice of a competent bankruptcy attorney. The Law Offices of Daniel J. Guenther are here to help you. Give us a call at (301) 475-3106. We are prepared to meet with you at our offices, remotely, and by phone. Congress proudly designates us as a Debt Relief Agency helping people get out of debt through Bankruptcy.