Using retirement funds to pay off credit card debt could be one of the worst financial decisions you can make. Using retirement funds to pay off credit card debt can have serious long-term consequences.

First and foremost, using your retirement funds means you’re taking money out of a tax-advantage account that’s supposed to help you build a nest egg for the future. You’re sacrificing potential long-term growth and losing out on compound interest by withdrawing some or all that money.

By withdrawing from your retirement funds, you’re losing out on the potential growth of those funds and facing significant penalties and taxes.

Retirement Funds Rate of Return versus the Cost of Credit

According to Daniel Blue in this Forbes Article, How to Use a Retirement Account to Pay Off Credit Card Debt, many Americans have both credit card debt and a retirement account, such as a 401(k) plan or individual retirement account (IRA). This means they are likely losing money faster than they are making it.

According to WalletHub’s Credit Card Landscape Report, interest rates average 17.98% for new credit card offers and 14.58% for existing accounts. Regarding retirement accounts, one commonly hears that investors can expect an average 6%-7% annual return in the stock market over the long term. Losing 17.98% per year on a portion of your money and then making 7% on another bucket of money means you could be going backward financially.

Some people consider taking funds out of their retirement account only to discover that withdrawing money from the IRA/401(k) plan would cost 20%-35% in penalties and taxes to the IRS. That would mean if a person took out $20,000 from their retirement account to pay off credit card debt, there could be up to $7,000 in penalties and taxes paid.

According to Erin El Issa in her article, Should I Use My Retirement Account to Pay Off My Debt, “You’re missing out if you haven’t yet been schooled on the magic of compound interest. The longer you keep your money invested, the more it will grow. So possibly the biggest expense you’ll incur if you withdraw your retirement funds early is the loss of future earnings.”

What is compound interest?

Compound interest is interest that’s earned on top of interest. When you invest money into a savings account, you earn interest on the principal amount you deposit. If you have a compound interest savings account, you earn interest on the principal amount plus the interest you gain over time. Compound interest makes your retirement fund grow faster because you are earning interest on your interest. To compound, add your principal to the interest earned in the previous year, and use that larger principal amount as the starting point to earn interest in the current year.

In her Forbes article, The Life-Changing Magic Of Compound Interest, Kate Ashford says that “Thanks to the magic of compound interest, the growth of your savings account balance would accelerate over time as you earn interest on increasingly larger balances. If you left $1,000 in this hypothetical savings account for 30 years, kept earning a 5% annual interest rate the whole time, and never added another penny, you’d end up with a balance of $4,321.94.”

Let’s say you have $20,000 in your retirement account and want to withdraw it to pay off credit card debt. Estimating a conservative annual return of 4%, if you leave this money alone, it will grow to $64,868 in 30 years. This means you’ll give up $44,868 by withdrawing your funds early. And that’s before factoring in the taxes and penalties.

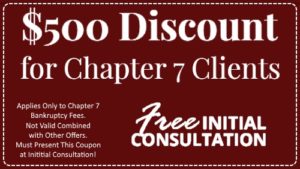

Bankruptcy can be an option to pay off credit card debt. You can file a Chapter 7 bankruptcy to clear credit card debt. The Bankruptcy Code works on almost all of a consumer’s unsecured debt. This type of bankruptcy may not discharge all of your taxes or student loans, but it can help give you a fresh start from credit card payments.

“Ultimately, using retirement funds to pay off credit card debt is generally not advisable, given the potential loss of compounding growth and the severe penalties involved.”

Not Clearing Debt Has Consequences

In this article, Can Filing for Bankruptcy Clear Credit Card Debt?, the FindLaw Staff highlights what credit card companies can do while still in debt.

While still in debt, credit card issuers may:

- Raise your interest rates.

- Charges late fees.

- Charge over-balance fees

- Give your account to a debt collection agency.

- Deny new credit card applications.

- File a debt collection lawsuit to try to claim repossessions.

Collection agencies can call you at home or work and demand payment of your total debt. This harassment is legal (with certain exceptions) unless you file a Chapter 7 or use another method to stop creditor harassment.

Alternatives to Consider

Speak to a bankruptcy attorney to decide if Chapter 7 bankruptcy is right for your financial situation. Every situation is different. This is what happens if you file for Chapter 7. Once you file for bankruptcy, you will get an “automatic stay” that:

- Stops creditors from calling.

- Stays wage garnishments for debts.

Yes, this is very complicated. Generally speaking, using your retirement funds to pay off credit card debt is not a wise decision. The money in your retirement account is probably earning substantially less than the cost of your credit card debt. If the situation were reversed, it would make more sense. Additionally, you are losing the value of compounding over time. The penalties paid to the IRS for early withdrawal of retirement funds can be severe and have significant consequences on your Federal and State taxes. Bankruptcy may or may not be your best option. But you will not know for sure unless you get all the information you need to make the best decision for you and your family.