In this article, I’ll focus on my chapter 7 bankruptcy and credit, my personal credit history story, and how my credit scores have significantly improved over a relatively short period of time.

Chapter 7 Bankruptcy and Credit

I will show, based on personal experience, that if you are patient, persistent and disciplined, you can substantially increase your credit scores following a Chapter 7 Bankruptcy in a relatively short period of time. It’s been four years since my bankruptcy was discharged.

I’ll never forget that feeling of financial freedom when I received my letter from the bankruptcy court that my Chapter 7 bankruptcy was approved.

Lending Agencies will contact you

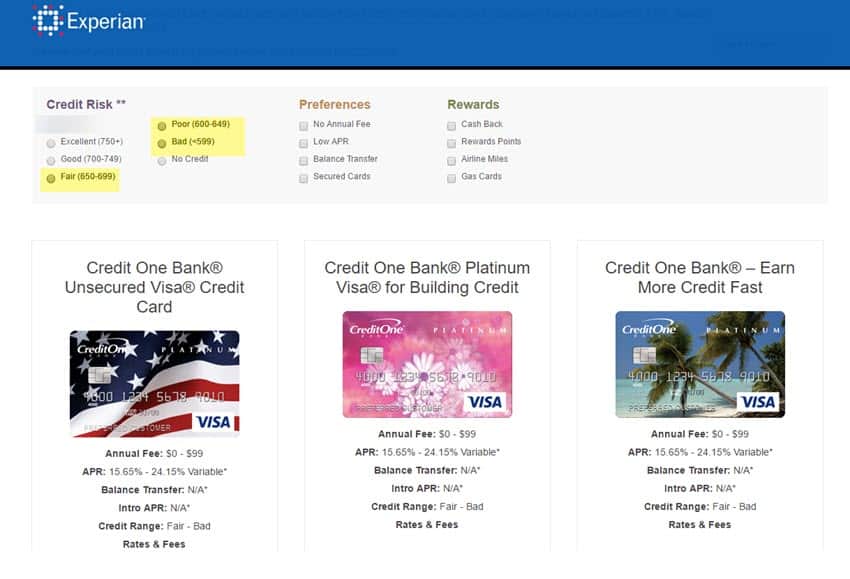

Immediately following my bankruptcy, my credit scores were around 535. My credit was terrible. Yet, there were credit card companies that contacted me. On the one hand, I was sick and tired of banks literally putting thousands of dollars at my immediate disposal. I took advantage of these offers when my lifestyle suffered for reasons already mentioned in previous articles.

But, my thought process was different now. I knew I had to start from the beginning. I needed to establish a brand new and positive credit history. I committed myself to being persistent and disciplined. So, I welcomed these offers. Here are a few bank lenders that offered this opportunity.

Obviously, these are all offers from the same bank. Despite what Credit One Bank shows in this picture, they charged me an immediate 0 annual fee. I was a captured customer. I didn’t have much choice, I took advantage of their offer.

Notice that the interest rate, annual APR is really high. I just made minor purchases and paid off the balance every month to establish a positive credit history. I would highly recommend you do the same.

Interim Offers will be Made

These banks share information. I mean really, who has ever heard of Credit One Bank? This isn’t a company that rolls off your tongue when you think of the more prominent banks that offer credit cards.

One such bank is Barclay. They offered me a credit card. I thought this was great. I know them. They’re big. This is great. I didn’t read the fine print. I primarily used them for business purposes. One day, I woke up. I realized that the annual APR was in the 24 percent range.

I had a dental issue and put a lot of those charges on this credit card. I did what I didn’t want to do, but needed to do. I quickly had a balance of just over $9,000. I easily managed this payment and was able pay down the balance by increasing my payment.

This stuff is all online, so I didn’t receive a paper bill. One day I decided to find out how much I was paying each month in interest. The amount was staggering. I was paying about $500 a month in interest. I needed another solution.

Based on my recent history of on-time payments, discipline and persistence, my scores improved significantly.

Today’s Results

Another solution is only possible if your credit scores are improving. Based on my recent history of on-time payments, discipline and persistence, my scores improved significantly.

I highly recommend Credit Karma. It’s free, they don’t commit you to any kind of membership or monthly bill. They provide an amazing service. Here’s a picture of my credit taken today from Credit Karma.

Improving Your Credit is a Process

Grant it! These are not the best credit scores available. However, when you consider that I’ve improved my credit from 535 to this range, it’s a huge improvement. In fact, I recently paid off that Barclay card with a non-secured loan from M&T Bank. It’s a 36-month loan with no pre-payment penalty. The terms of this new agreement enhances my persistence and discipline.

I was also able to secure a new credit card with M&T Bank. It’s their Visa Signature Credit Card. You can read a review on the M&T Bank Signature Credit Card at Card Ratings. Currently, they are offering a zero percent interest rate for the first year, then it’s annual APR is just below 14 percent. That’s a whole lot better than 24 percent.

In summary, this is my personal story on my Chapter 7 Bankruptcy and Credit history. I’ve been persistent and disciplined in my approach to credit over the past four years. I feel I’m well on track to improve my credit scores over the next few years. I hope this article helps others that might be wondering what “life is like” after bankruptcy. In my case, it has truly given me a fresh financial start.

Chapter 7 Bankruptcy and Credit History: A 2021 Update

It has been four years since I wrote this article. I thought it was time for an update. I’m not breaking any world records, but I believe I’m doing well and still progressing. Here is a recent update on my FICO scores. In October, 2021 Experian reported that my FICO score was at 749. This put me in the “very good” range for the first time. Discipline and persistency really do pay off!

Personal Disclaimer: I am not an expert in getting out of debt. For many, this is a major undertaking, every situation is different, and that may mean you need to enlist the help of others.

Financial counselors organizations affiliated with the National Foundation for Credit Counseling can help you get out of debt and stay on track. You might also consider sharing your plans with a friend or family member and ask them to hold you accountable.