This is my personal bankruptcy story. In my case, I was able to file a Chapter 7 bankruptcy in my hometown of Waldorf, Maryland.

My Personal Bankruptcy Story

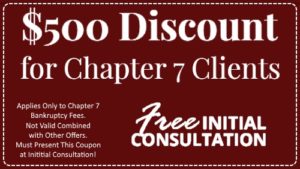

Waldorf is a city in Southern Maryland about 25 miles south-east of our nation’s capital. This is a personal bankruptcy story of failure and how failure can breed success. But it took a lot of courage and professional help to get to where I am today. The small investment I made to secure my Chapter 7 bankruptcy was the best investment I’ve ever made. This is a story of overcoming failure and turning failure into success.

I’m sharing my experience to help others by perhaps helping you overcome some common bankruptcy myths based on my personal experience. To be sure, it was initially very scary. I owed a lot of money to a lot of creditors. I had placed my family into a huge financial black hole.

I’m not the type of person scared about anything, but this was uncharted ground. I’ve always been the type to work my way through problems by eventually finding the right solution. However, bankruptcy carried an extremely negative personal and professional connotation. Yet, I was buried in debt. It got so bad that I couldn’t even pay the interest on my debts.

I spent down my considerable retirement savings to continue to meet my obligations. When I exhausted those funds, I was literally broke. Plus, I paid a huge penalty for using my qualified retirement funds; in other words my IRA. Read about why this is not recommended here.

LESSON LEARNED: If you are considering a Chapter 7 or Chapter 11 bankruptcy, consult a qualified bankruptcy attorney on how best to conserve those funds. When I use an attorney, I find one that has years of experience and considered the best in my area.

My Failure Which Led to My Personal Bankruptcy

It all started in the 2006-08 timeframe. At that time I had a relatively successful insurance business. This business was mostly based on health insurance sales and service. Most of my clients were in the real estate or mortgage business. I loved this aspect of my business, it was very exciting at that time.

One of my clients offered me an opportunity to purchase a couple of lots and build ocean access homes in North Carolina. I had the money to invest, they had a great plan and I invested. I invested in the American Dream, my family dream.

Consult a qualified bankruptcy attorney on how best to conserve your funds.

In retrospect, this was the top of the housing and mortgage bubble in our country. The bubble burst! It led to the largest financial crisis in our country since the Great Depression. I lost my American Dream, but I never lost my family or family dream. I continued to pour savings and retirements funds into my investment.

At the time, I was working with great folks who worked the banks and created hope for help. But, we are all just swimming in quick sand. The more money we spent, the more we lost. The real estate market crashed and the banks were just trying to limit damage.

As the real estate market crashed, I continued to spend money to support my mortgage loans on my properties, but my real estate and mortgage clients were forced to lay-off their employees. As a result, my insurance commissions began to significantly decrease and eventually disappear.

I was financially leaking at both ends. My debt was draining my financial resources and my income was decreasing fast.

This is my personal bankruptcy story. I’m sure you have your own to tell. Stay tuned for my story on how I turned adversity into opportunity…