Let’s face it. You are now free of debt. You really did well! The last thing you might be thinking about is budgeting after bankruptcy. But this is also a great time to get your life organized financially.

Starting well before you filed for bankruptcy, it was probably a struggle to maintain a balance between your finances and life. However, even though you have filed for bankruptcy, life doesn’t stop. You’ll want to take a few financial steps and make some decisions to start rebuilding your life.

Budgeting After Bankruptcy and Save Money

After bankruptcy, families often find themselves with a lot more disposable income but not a lot of knowledge on how to use it wisely. As a result, many consumers end up blowing their money on things that are not in their best interest.

To avoid this, it is important to learn budgeting after bankruptcy and how to save adequately. There are a lot of actions you can do to make this process easier, more manageable, and more enjoyable for you.

- Create a budget. This will show you how much you should be saving each month.

- Create a savings account. This will allow you to start building up a nest egg that you can use as you pay off future debts. It will help a lot in building new credit.

Make a New Budget after Filing for Bankruptcy

You may or may not have had a household budget before filing for bankruptcy. However, if you filed for any form of bankruptcy — including Chapter 7 bankruptcy — now is a great time to create or reassess your budget.

Setting up a new budget post-bankruptcy allows you to plan for your financial future. Fortunately, your new budget will no longer include all the burdensome debt which you discharged in your Bankruptcy. You can begin by dividing your expenses into the following three categories:

Fixed

Fixed expenses are expenses that occur regularly: Monthly or Quarterly.

They are always the same, or close to the same. For example, a mortgage payment, rent, or a car payment would be a fixed expense.

Variable

Variable expenses are also monthly.

However, variable expenses vary from month to month. Your grocery bills, credit card bills, or utility bills are examples of variable expenses.

These are the expenses you should aim to reduce in your budget.

Irregular

Finally, irregular expenses do not arrive on a monthly schedule.

Instead, they are unpredictable. Car repairs or medical expenses associated with an injury are an example of an irregular expense.

You should arrange these expenses onto a spreadsheet.

The question is not how long can you live on what you currently have, but how long can you live on what you earn.

Design a Budget Spreadsheet

A household budget allows you to track your expenses, find out where you spend money and focus on saving money. Making a physical document often helps people stick to a budget.

You can also use programs like Excel or Google Sheets to make a spreadsheet, although something as simple as a notebook will work just fine.

Learn More about Budgeting after Bankruptcy

Budgeting after bankruptcy allows you to work to rebuild your finances.

Now is the time to create a budget, track your expenses, and start fresh. And it’s a lot more fun creating a budget without all the debt you discharged in Bankruptcy.

A balanced budget is very rewarding.

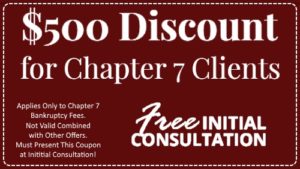

You can learn all about filing for bankruptcy and recovering afterward with guidance from the Law Offices of Daniel J. Guenther.

Nothing contained herein is intended to give legal advice or create an attorney/client relationship.

We are proud to say we have been designated by Congress as a Debt Relief Agency helping people get out of debt through Bankruptcy.

Bankruptcy help and advice for individuals and couples

You’ve been through a lot. You will need to rebuild your credit and start over. It can be difficult to get back on your feet after having to declare bankruptcy.

You’ve been through a lot. You will need to rebuild your credit and start over. It can be difficult to get back on your feet after having to declare bankruptcy.

Guenther Law is the best resource for people going through bankruptcy. From resources to education to legal support, we have compiled everything you need to know about the process and how you can start rebuilding your credit.

There is no “perfect” way to live after bankruptcy. It is important to find what works for you and your family. You need to be conscious of your spending to ensure that you are staying as financially healthy as possible. That’s why budgeting after bankruptcy is essential.

The truth is that there really are no absolute rules to managing your finances after bankruptcy. You are your own boss and you make your own decisions. Everyone’s situation is different, and what worked for one person may not work for someone else.

There is no way to know for certain what is going to happen to you – it can be tough to figure it out. However, the general guidelines outlined in this article can help you manage your finances so you can start living your life again after bankruptcy.

- Guenther Law helps individuals and families in need of guidance going through bankruptcy.

- Guenther Law helps people find information about how to live after bankruptcy, how to build credit, how to buy a car after bankruptcy, how to save for a down payment, and more.

- Guenther Law can help you get back on the right track.

We’re here to help you find the best solution for your situation. We help people get back on their feet after bankruptcy. We offer the right solutions at a price you can afford.

Guenther Law: The Bankruptcy Experts – Bankruptcy Law and Advice